Investing regularly has become an essential part of modern financial planning. Many individuals aim to build wealth steadily without depending on unpredictable market movements. This is where systematic investing plays an important role. When you invest in SIP, you commit to disciplined contributions over time, allowing your money to grow gradually. With the support of an online trading app, starting and managing systematic investments has become more accessible for individuals across different income levels.

Understanding how to invest in SIP properly can help investors achieve consistent monthly returns while maintaining financial stability. This explains the process, benefits, and strategies involved in systematic investing, focusing on long-term consistency rather than short-term outcomes.

Understanding the Concept of SIP

A systematic investment plan allows individuals to invest a fixed amount at regular intervals. This approach removes the need to predict market conditions and encourages steady participation in the investment process.

How SIP Works in Simple Terms

Instead of investing a large amount at once, SIP enables periodic investments, usually on a monthly basis. This structure helps in spreading investment risk over time and reduces the impact of market fluctuations.

Key aspects include:

- Fixed investment amount

- Regular investment schedule

- Long-term investment horizon

When investors invest in SIP, they gradually accumulate units over time, helping create a balanced investment pattern.

Why Consistency Matters in SIP Investing

Consistency is one of the main strengths of systematic investing. Regular contributions help investors stay committed to their financial goals, regardless of market conditions.

Benefits of Consistent Monthly Contributions

- Encourages disciplined saving habits

- Reduces emotional decision-making

- Helps manage market volatility naturally

- Supports long-term wealth accumulation

By maintaining consistency, investors allow time and regular contributions to work together effectively.

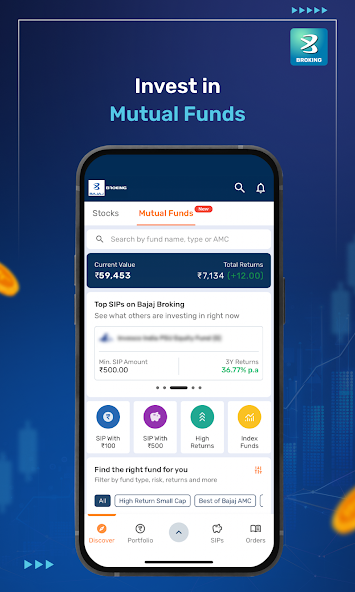

Role of an Online Trading App in SIP Investments

Technology has simplified the way people manage investments today. An online trading app provides a convenient platform to start, monitor, and adjust SIP investments efficiently.

Advantages of Using Digital Investment Platforms

- Easy setup of systematic investment plans

- Automated monthly contributions

- Transparent tracking of investment progress

- Quick access to account information

An online trading app helps investors stay organized and ensures that monthly investments continue without manual intervention.

How to Invest in SIP Step by Step

Understanding the correct process is essential before beginning systematic investing.

Step 1: Define Financial Objectives

Investors should identify clear goals such as long-term savings, income planning, or future financial security. Clear objectives help determine the investment duration and contribution amount.

Step 2: Decide the Investment Amount

The investment amount should align with monthly income and expenses. SIP allows flexibility, making it easier to adjust contributions as financial situations change.

Step 3: Choose the Investment Duration

Longer durations generally provide better stability. When investors invest in SIP for extended periods, they allow market movements to balance out naturally.

Step 4: Monitor Progress Periodically

Although SIP does not require constant attention, reviewing progress occasionally helps ensure that investments remain aligned with goals.

Managing Risk Through SIP Investing

Risk management is a crucial part of any investment strategy. SIP reduces risk by spreading investments over time instead of relying on a single market entry point.

How SIP Helps Reduce Market Impact

- Purchases occur at different market levels

- Average cost of investment stabilizes over time

- Reduces exposure to sudden market changes

This approach supports steady growth rather than short-term fluctuations.

Importance of Long-Term Perspective

Systematic investing is most effective when approached with patience. Investors who focus on long-term outcomes are more likely to benefit from gradual market growth.

Staying Committed During Market Changes

Short-term market changes can create uncertainty, but SIP encourages continued participation regardless of conditions. Maintaining a long-term mindset allows investments to grow steadily.

Common Mistakes to Avoid When You Invest in SIP

Avoiding common mistakes helps improve consistency and outcomes.

Mistakes That Can Affect SIP Performance

- Stopping investments due to short-term market movements

- Frequently changing investment plans without review

- Ignoring financial goals while investing

A disciplined approach ensures that systematic investing remains effective over time.

How SIP Supports Financial Planning

Systematic investing fits well into structured financial planning. Regular contributions allow individuals to plan future expenses and financial goals more efficiently.

Financial Benefits of SIP Planning

- Predictable investment pattern

- Easier budgeting and expense management

- Gradual wealth creation

By integrating SIP into financial planning, investors can maintain stability while pursuing growth.

Tracking and Reviewing SIP Investments

Periodic reviews help ensure investments remain aligned with objectives.

What to Review Regularly

- Investment duration

- Contribution amount

- Progress toward financial goals

Using an online trading app simplifies tracking and allows investors to stay informed without complex processes.

Conclusion

Systematic investing offers a structured way to achieve consistent monthly returns through disciplined contributions. When individuals invest in SIP, they benefit from regular participation, reduced market impact, and long-term stability. With the convenience of an online trading app, managing systematic investments has become easier and more transparent.

By focusing on consistency, patience, and clear financial objectives, investors can use SIP as an effective tool for gradual wealth creation. Choosing a long-term approach and avoiding emotional decisions helps ensure that systematic investing remains aligned with financial goals. Ultimately, the decision to invest in SIP supports steady progress toward financial security while maintaining control and clarity throughout the investment journey.