Managing sudden financial needs can be stressful, especially when traditional borrowing methods involve long waiting periods and paperwork. In such situations, a Loan App offers a practical way to access money without delays. With the rise of digital finance, people now prefer an Online Loan process that allows them to apply, verify, and receive funds from one place.

A Loan App simplifies borrowing by removing unnecessary steps and allowing users to apply from anywhere. Whether it is a medical emergency, household expense, or temporary cash gap, an Online Loan through a digital platform helps users get cash instantly with ease and transparency.

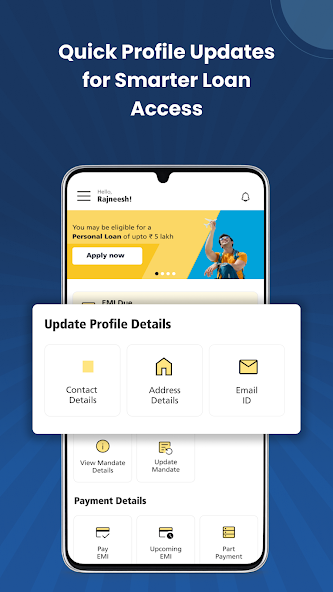

Understanding How a Loan App Works

A Loan App is designed to help users apply for financial assistance through a digital process. Instead of visiting offices or submitting physical documents, the entire process is handled online.

Simple Digital Application Process

The first step involves completing an application form within the app. Basic personal, employment, and income details are required. This process takes only a few minutes and can be completed using a mobile device.

Online Verification System

Once the application is submitted, the Loan App performs verification using digital records. This reduces the time spent on manual checks and helps move the application forward quickly.

Quick Fund Access

After approval, funds are sent directly to the applicant’s bank account. This makes the Online Loan process suitable for urgent financial needs where time matters.

Why People Choose Online Loan Options

Digital borrowing has become a preferred option due to its ease and flexibility. A Loan App allows users to apply for funds without adjusting their daily schedule.

Convenience and Accessibility

An Online Loan can be applied for at any time. There are no fixed hours, making it useful during emergencies or unexpected expenses.

Reduced Paperwork

Traditional loans often require multiple documents and repeated visits. A Loan App minimizes documentation by using online verification methods.

Transparent Information

Loan details such as repayment terms, duration, and charges are clearly mentioned before submission. This helps users understand their obligations before proceeding.

Situations Where a Loan App Can Help

A Loan App can support a wide range of financial needs. It is not limited to one specific purpose, giving users flexibility in how they manage their funds.

Emergency Expenses

Unexpected medical bills or urgent repairs may require immediate funds. An Online Loan provides quick access without delay.

Monthly Cash Shortages

Sometimes income and expenses do not align. A Loan App can help bridge short-term gaps until the next income cycle.

Personal Commitments

Family events, travel needs, or essential purchases can be managed easily through a digital loan process.

Eligibility and Basic Requirements

Although the process is simplified, certain basic criteria must be met to apply through a Loan App.

Age and Income Criteria

Applicants usually need to be within a specified age range and have a steady source of income. This helps ensure repayment capability.

Valid Identification

Digital identification and bank account details are required to complete the Online Loan process smoothly.

Mobile and Internet Access

Since the process is app-based, access to a smartphone and internet connection is essential.

Responsible Use of a Loan App

While a Loan App provides quick financial support, responsible usage is important for long-term financial stability.

Borrow Only What Is Needed

Applying for an Online Loan should be based on actual requirements. Borrowing excess amounts may lead to repayment challenges.

Understand Repayment Terms

Before submitting the application, users should review repayment schedules and timelines carefully.

Plan Repayments in Advance

Timely repayments help maintain financial discipline and avoid additional charges.

Security and Data Protection

Digital platforms use secure systems to protect user information. A Loan App relies on encrypted processes to safeguard personal and financial data.

Secure Digital Access

Most Online Loan platforms use authentication methods to prevent unauthorized access.

Privacy of Information

User data is processed through secure servers, reducing the risk of misuse when proper guidelines are followed.

Benefits of Choosing a Loan App Over Traditional Methods

A Loan App offers a faster and simpler alternative to conventional borrowing options.

Time-Saving Process

The digital process eliminates long approval cycles and manual reviews.

Location Independence

An Online Loan can be applied for from home, work, or while traveling.

Clear Communication

Loan updates, approval status, and repayment reminders are communicated digitally for better tracking.

Common Mistakes to Avoid

Using a Loan App wisely helps users gain the most benefit without financial strain.

Ignoring Terms and Conditions

Skipping details may lead to misunderstandings later. Reviewing all information before accepting an Online Loan is essential.

Delaying Repayments

Late repayments can affect future borrowing options. Setting reminders helps stay on track.

Multiple Applications at Once

Applying for several loans simultaneously may complicate repayment planning.

Conclusion

A Loan App provides a practical solution for those who need quick financial assistance without complex procedures. By using an Online Loan platform, users can apply, verify, and receive funds in a structured and time-efficient manner. The digital process helps reduce delays while offering clarity and convenience.

When used responsibly, a Loan App can be a helpful financial tool during urgent situations or short-term needs. Understanding the process, reviewing terms carefully, and planning repayments ensure that an Online Loan remains a supportive option rather than a burden. With proper usage, digital borrowing continues to offer a reliable way to get cash instantly anytime funds are required.