Stock market apps have changed how India invests. Whether you’re a beginner buying your first stock or a regular trader managing multiple positions, your app experience matters. But with so many options, it’s not about choosing the most popular app — it’s about finding the one that’s actually built to serve your needs.

Here’s what every stock market app must have: the essentials that impact performance, usability, and trust.

1.Seamless Demat Account Opening

This one’s non-negotiable. If an app still asks for printouts or manual KYC, it’s outdated. A good app should let you open a demat trading account in minutes using Aadhaar-based eKYC, PAN, and digital signatures. It should also sync instantly with your trading account and bank — no third-party logins, no extra paperwork. If the process takes more than 10–15 minutes, it’s not built for modern investors.

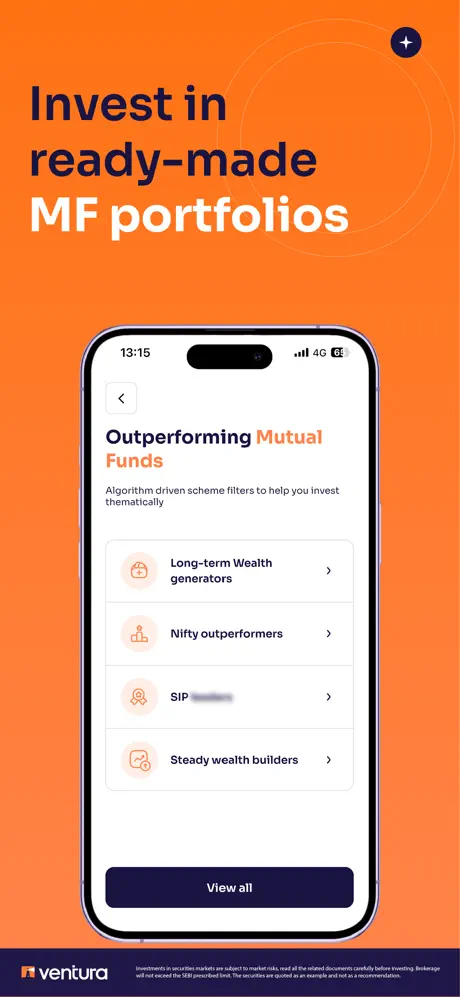

2.A Clean And Friendly Interface

You shouldn’t need a tutorial to find your way around. A well-designed demat account app feels intuitive. It lets you:

- Track your portfolio performance at a glance

- Add/remove stocks from your watchlist quickly

- Place a trade in just 2–3 taps

Visual clarity matters too, cluttered screens lead to decision fatigue. The best apps do more by showing less.

3.Real-Time Market Data and Alerts

A few seconds can make a big difference when the markets move fast. That’s why live data isn’t a “premium” feature anymore, it is basic. Your app should give you:

- Real-time price updates (NSE/BSE)

- Instant alerts when your chosen stock hits a price

- Option to set volume-based or percentage-change alerts

Without these, you’re always reacting late, and in trading, late often means loss.

4.In-App Research and Smart Tools

A demat account gives you access to the markets, but the right features help you understand those markets. A solid stock market app will include:

- Basic fundamental and technical data

- Stock screeners based on filters like P/E, ROE, sector

- Analyst ratings and news for context

- Charts you can read on your mobile

If you have to rely on five different websites to make one investment decision, your app isn’t helping you — it’s slowing you down.

5.Execution Speed and Security

This is another basic feature, if you want to start investing online, you need to place trades fast, and keep your data safe. The app should execute trades without lags or crashes, even during high-traffic days like IPOs or budget announcements. It should also offer:

- Two-factor authentication

- Biometric login

- End-to-end encryption

- Fraud alert mechanisms

You’re trusting it with real money. Security can’t be optional.

6.Performance Dashboard That Makes Sense

One of the most underrated demat account features is a smart dashboard. It shouldn’t just show your holdings, it should help you analyze them. Look for apps that break down:

- Unrealized vs realized gains

- Sectoral distribution

- Time-based returns

- P&L per stock

When you can track performance clearly, you make better, more confident decisions.

The right stock market app isn’t the one with the flashiest UI or the loudest ads. It’s the one that quietly helps you invest better, faster, and smarter — whether you’re buying your first share or managing a portfolio.

So before you open a demat account, ask yourself: does this app simplify your investing journey or complicate it?

Choose the one that does the former. The rest is just noise.